Cutting mortgage application time and reducing support calls through design

Cutting application time and reducing support calls with a consistent design system

PURPOSE

Create a better experience for both our external and internal customers without trade-offs.

ROLE

Lead Product Designer

BACKGROUND

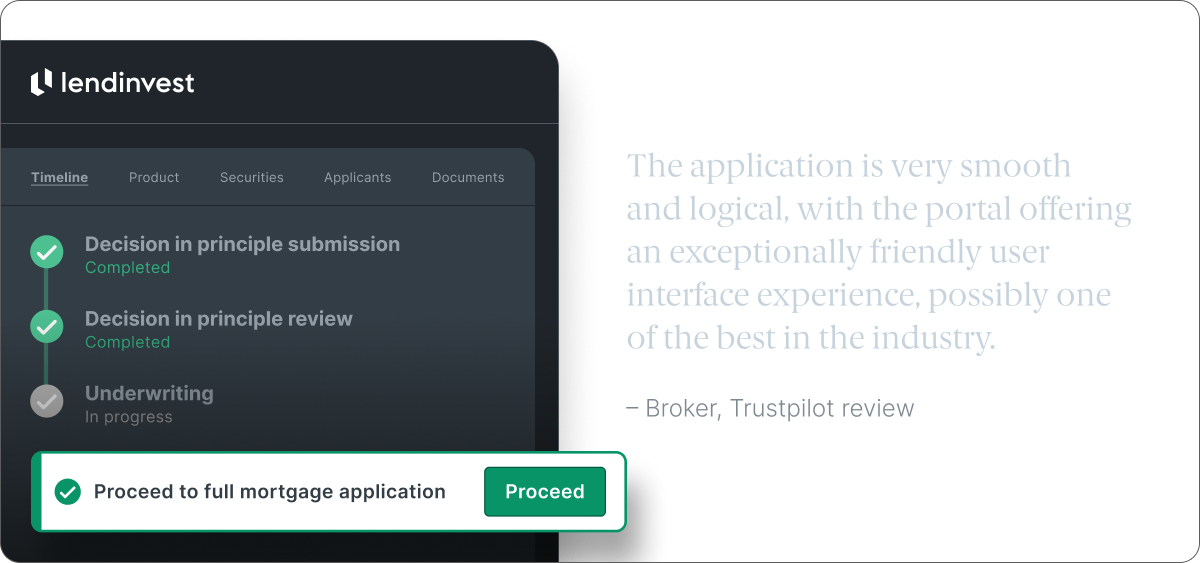

LendInvest has market-leading technology, for which we are always nominated for or winning awards. Both brokers and LendInvest save time, money, and effort thanks to our smart automations, elimination of paper forms, and dramatically reduced communications.

RESPONSIBILITIES

As design lead I drove the initial research, presented a case for the insights, designed the final experience, and aligned product, tech, and stakeholders on a delivery strategy. I oversaw other product designers’ contributions to the project and drove the marketing and data efforts.

Some unfortunate examples of the layout breaking for our users.

ISSUES

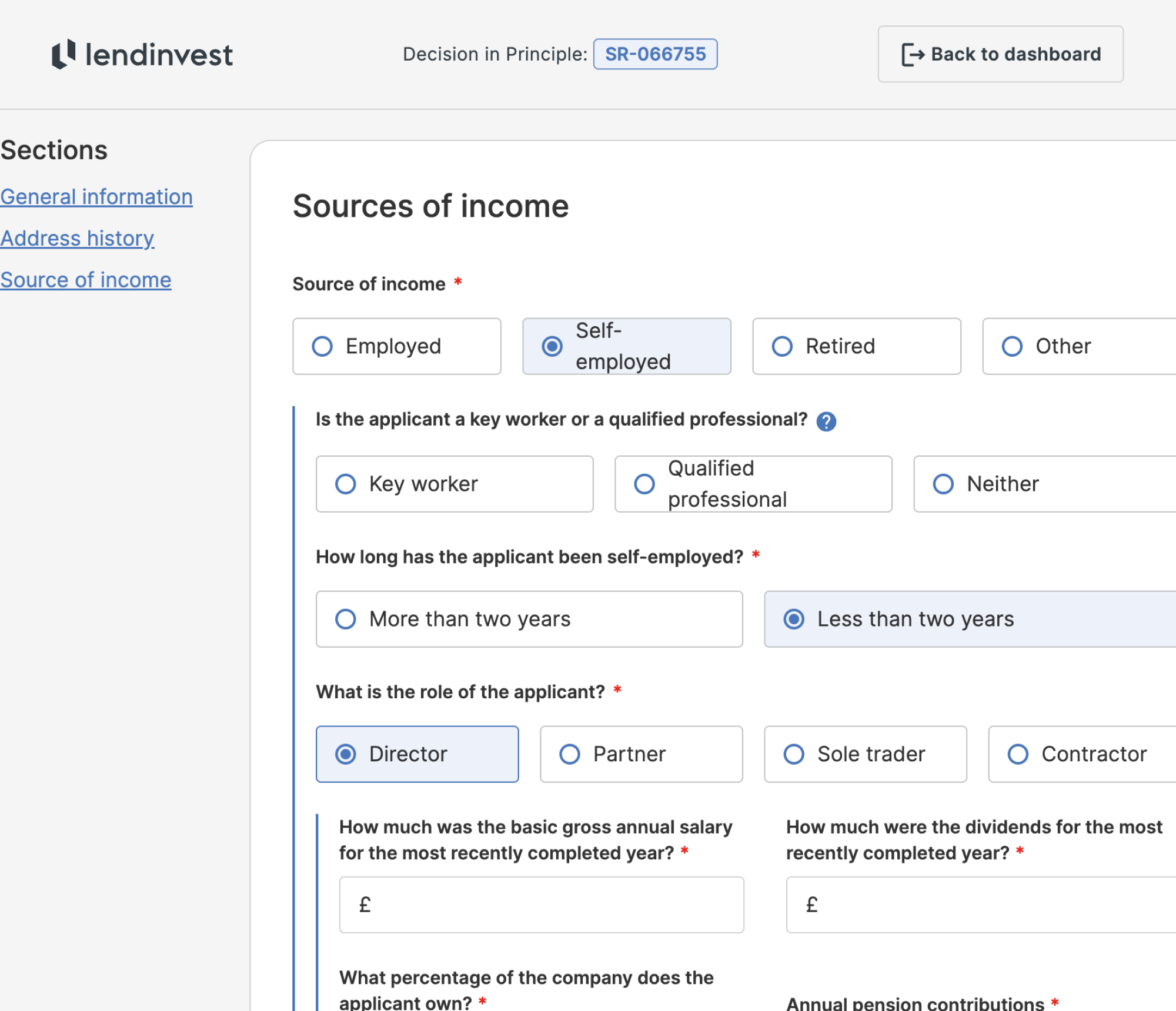

The LendInvest Mortgages Portal was originally designed under the stakeholder assumption that brokers worked exclusively on desktops. Post-launch data revealed otherwise: 41% of brokers resized browsers or used smaller devices, breaking layouts and making forms unusable.

We speculated this was because they’d pull up their fact-find docs, or CRMs, or however they managed their clients’ information – something which was later confirmed during discovery interviews and visits to brokerages.

This created significant usability issues, with inaccessible inputs, broken layouts, and heavy cognitive load through poorly-laid out questions. We’d see a lot of inbound call traffic from brokers who were stuck mid-way through an application.

THE SOLUTION

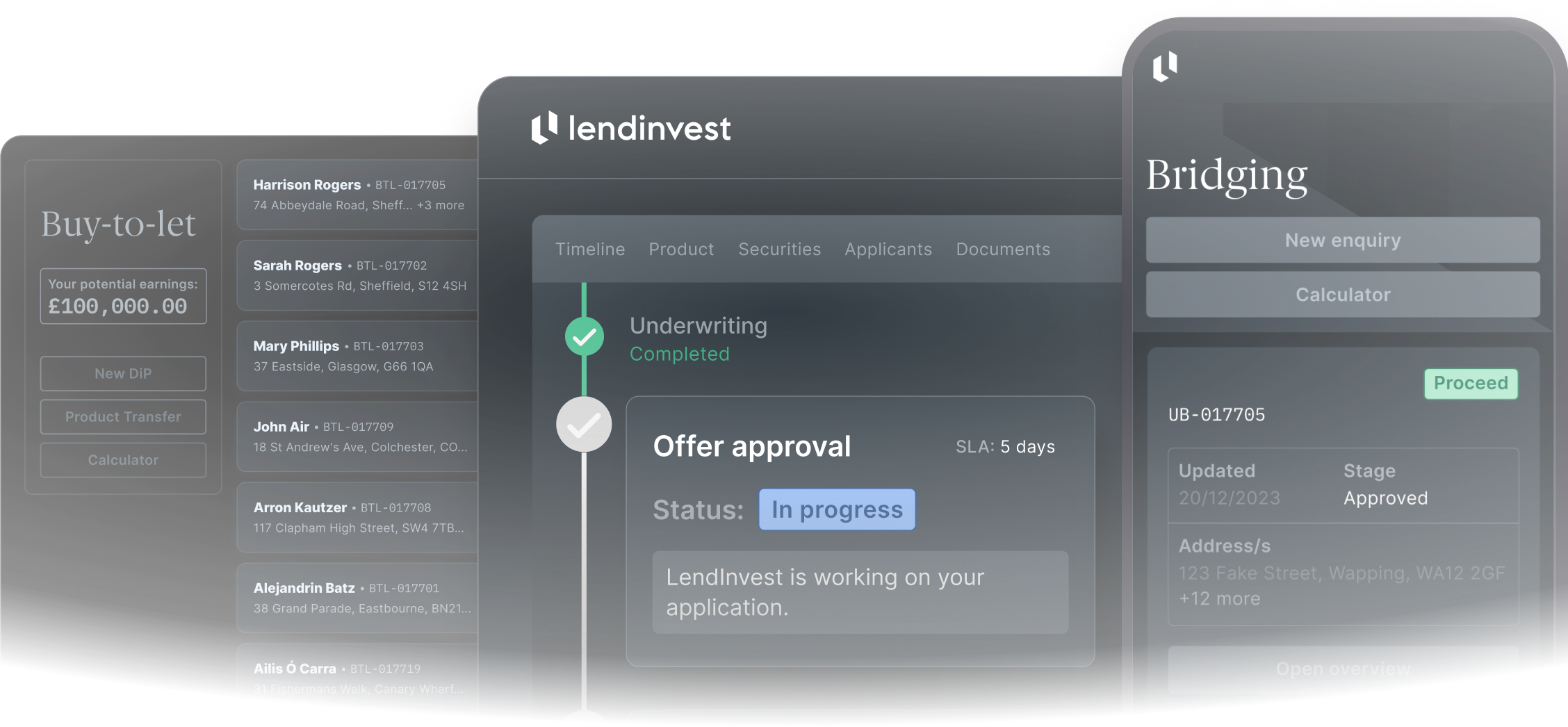

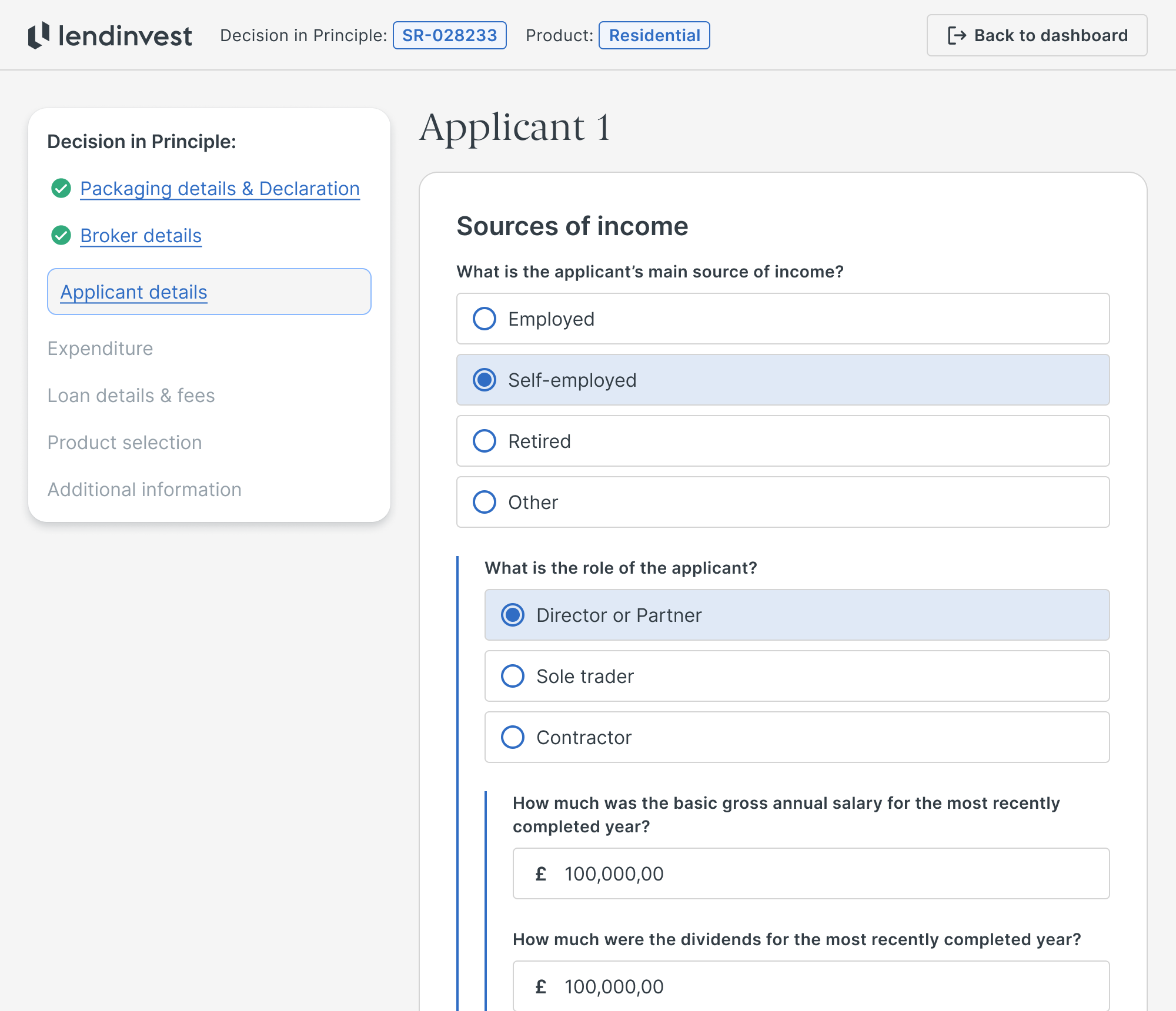

We redesigned the application journey around a single-column, fully responsive design system. Whether it’s across usability, accessibility, confidence or maintaining less technical debt, single-column always beats multi-column forms. CXL ran a study where they found users took 15.4 seconds less to complete the same form across these layouts.

Using progressive disclosure and conditional questions, we went further to prevent applications from seeming overwhelming, while cutting the required questions by ~30%. By collaborating with stakeholders we ensured questions were properly structured and grouped more sensibly.

A more targeted set of questions would also ensure that less following up was required by our internal staff, so they could spend more time on service and judgement and less on paperwork – making the process quicker, simpler and far less stressful for everyone involved.

THE RESULTS

11%

reduction in time to complete an application.

41%

of brokers benefited from the responsive layout.

5%

lift in conversions on highly-performing enquiry forms.

55%

reduction of inbound support calls related to applications.

After the release, 41% of users benefitted from the responsive layout with a third fully adopting smaller devices – something that hadn’t been possible before. Most notably, support calls dropped by 55%. By cutting unnecessary questions and making forms accessible on any device, brokers were able to complete applications independently.